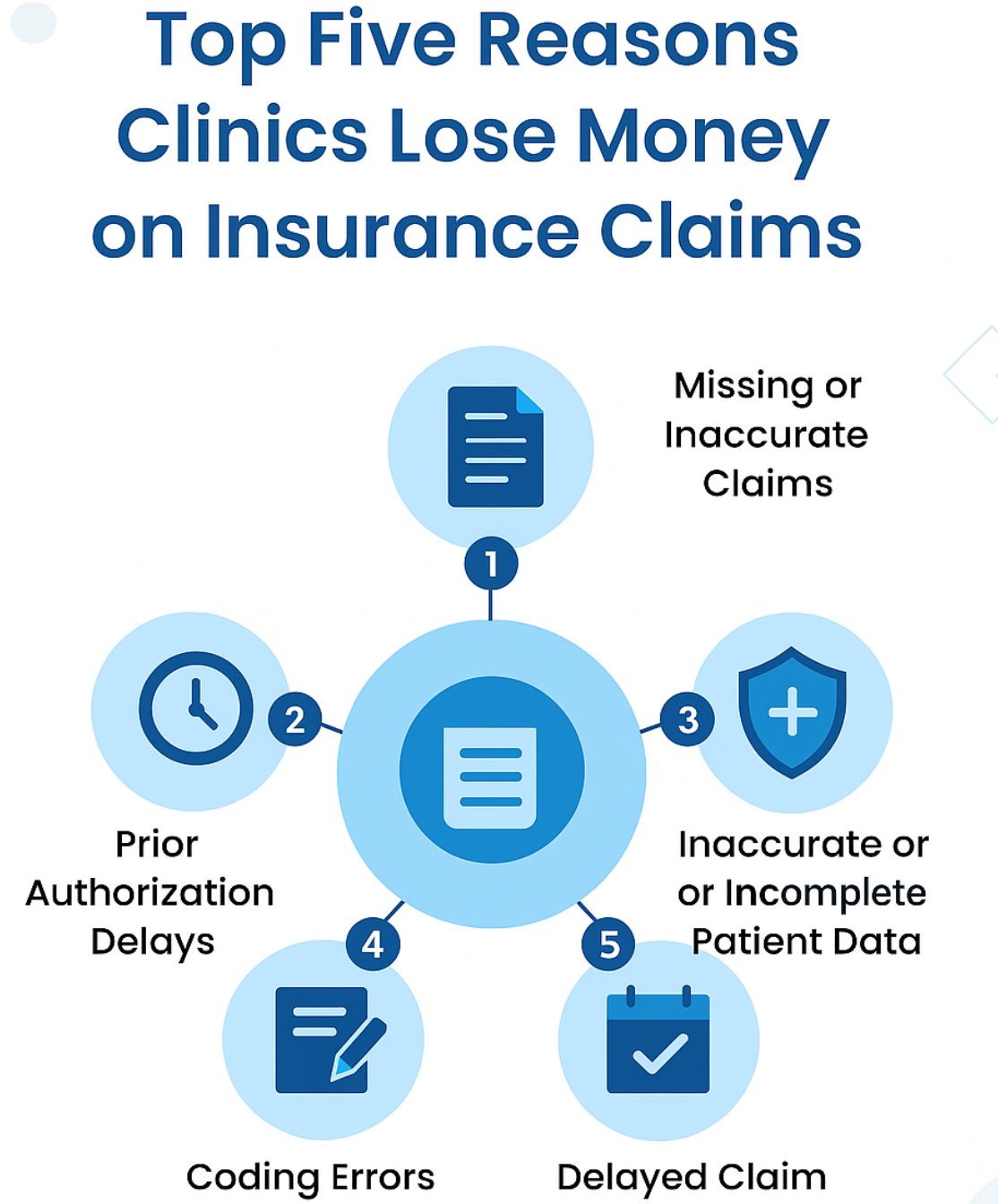

Top Five Reasons Clinics Lose Money On Insurance Claims

Ask any clinic owner how business is going, and you’ll probably get a familiar answer that margins are tight, expenses keep climbing, and reimbursements aren’t what they used to be. But behind these everyday financial worries lies a bigger issue that rarely receives enough attention: the growing number of insurance claim denials quietly eroding revenue.

The American Hospital Association (AHA) reports a steep rise in denials across U.S. hospitals. Between 2022 and 2023, commercial claim denials climbed to 20.2%, while Medicare Advantage claims jumped to 55.7% (AHA Report, 2024). And these reflect real financial pressure, delayed cash flow, and hours of extra work for billing teams already stretched thin.

Understanding why these denials happen is the first step toward stopping them. So, let’s break down the top five reasons clinics lose money on insurance claims and what can be done to fix them before they impact the bottom line.

The data from 2024 and 2025 tells a clear story. The top denial triggers haven’t changed much, but their impact continues to grow:

- Incorrect or missing claim data is increasing from 46% in 2024 to 50% in 2025.

- Authorisation issues follow up to 35%

- Patient registration errors are increasing from 30% to 32%

- Coding mistakes still account for 24%

- Services not covered are holding at 23%

At first glance, these may appear to be small, correctable errors. But together, they represent millions of dollars lost across clinics every year. The problem is that preventable mistakes are repeated daily, which accumulate into major revenue gaps.

Missing or Inaccurate Claims

Claim denials occur for various reasons, and Inaccurate Claims are one of them. Small mistakes can turn into big financial losses, and even a minor error in patient data, such as an incorrect birth date or missing insurance details, can result in delayed payments or outright denials. According to the State of Claims 2024 Survey, 46% of healthcare leaders say missing or inaccurate data is one of the top reasons for claim denials. In fact, 30% of patient information is often incomplete or incorrect, further creating unnecessary bottlenecks in reimbursement.

The issue grows when clinics continue to rely on manual processes. Nearly 50% of providers still manually review denials, which slows down resolution and adds to administrative costs. What’s more, 36% also report that authorisations are a recurring cause of delays. Simply put, human errors are expensive, and Clinics end up losing money not because payers refuse to pay, but because the claims themselves go out flawed.

That’s exactly why so many healthcare organisations are now leaning on automation and AI as real solutions to stop revenue from slipping away. Because when routine data entry and checks are handled automatically, there’s less room for error, and faster claim approvals lead to a noticeable drop in denials. A TruBridge study even suggests the healthcare industry could save $9.8 billion annually by integrating intelligent automation into denial management and revenue cycle workflows.

The Hidden Cost of Prior Authorisation Delays

Prior authorisation is one of those steps that sounds easy but ends up slowing everything down. Clinics have to wait for approval from the insurer before giving certain treatments, but those approvals don’t always come on time, or they miss important details. And this delayed or denied claims leads to clinic loses both time and money.

In some cases, treatment begins before authorisation comes through, and sometimes only part of the service gets covered. This puts providers in a tough spot, as itself a draining process to care for patients while dealing with the uncertainty of whether they’ll actually be reimbursed.

Look at this 2023 AMA Prior Authorization Physician Survey found that doctors and their teams spend an average of 12 hours every week just handling these approvals. That’s time taken away from patient care and a major cause of burnout and stress among healthcare staff.

To make matters worse, payer rules keep changing. Teams often have to navigate multiple portals and systems to submit or track authorisations. According to the State of Claims 2024 Survey, 36% of healthcare leaders rank prior authorisation issues among the top three causes of denied claims.

But there’s a silver lining across the way: automating the prior authorisation process can make a real difference. The CAQH Index (2021) estimates that automation could save the healthcare sector $437 million every year. And with the Centres for Medicare & Medicaid Services (CMS) pushing new regulations for electronic workflows starting in 2026, adopting automations is becoming a necessity.

By streamlining these approvals through automation, healthcare providers can cut down on administrative load, reduce denials, and ensure patients get timely care without financial setbacks.

Inaccurate or Incomplete Patient Data

Among all the reasons clinics lose money on insurance claims, inaccurate or incomplete patient data remains one of the most common and costly reason behind it. Even something as small as a misspelt name, outdated address, or incorrect insurance detail can lead to a claim being denied. Small things like these end up stopping the claim from going through. What looks like a tiny error turns into delays, extra back-and-forth work, and payments getting stuck for weeks. According to the Patient ID Coalition Survey, 72% of healthcare professionals have experienced billing or reimbursement delays due to mismatched or missing patient data. Adding to the chaos in the scenario even more concerning, 70% say such errors lead to patients undergoing duplicate or unnecessary tests, a direct result of difficulties in managing patient identities.

The absence of a national strategy for patient identification only makes the problem worse. Duplicate records and mismatched data not only inflate costs but also put patients at risk. Studies show that duplicate medical records cost an average of $1,950 per inpatient stay and over $1,700 per emergency visit. On a broader scale, 35% of all denied claims stem from inaccurate patient identification, costing an average hospital around $2.5 million each year, and the U.S. healthcare system a staggering $6.7 billion annually.

The truth is, even one small data error can turn into a significant financial loss. But with the right technology in place, these issues can be caught before they escalate. Automating key administrative processes from data entry to claim submission helps ensure information accuracy and prevents denials tied to missing or incorrect details.

The 2021 CAQH Index estimates that automation could save the healthcare industry $437 million every year by improving efficiency and reducing manual errors.

Coding Errors & Documentation Gaps

Coding mistakes and weak documentation are silent revenue drains for clinics. When procedures and diagnosis codes don’t match the underlying medical records, payers often reject the claims outright. Mis‐matched procedure and ICD codes, missing modifiers, or outdated billing codes are prime culprits.

Research shows this issue is far from rare. Some studies suggest that coding-related denials contribute significantly to the overall denial burden, as many as one in four denials in primary care visits are attributed to coding mistakes. According to the Medical Group Management Association (MGMA), about 20% of all medical claims end up getting denied, mostly due to coding mistakes. What’s even more concerning is that nearly 60% of those denied claims are never sent back for review, leading to significant revenue loss for healthcare providers. But the costs go beyond rejections. Clinics need to spend time and resources appealing denials, correcting codes, and resubmitting claims — efforts that eat into staff productivity and reduce the net reimbursement. For hospitals in particular, the burden is heavy: on average, each denial costs a hospital $181 (for rework and appeals) in addition to the lost revenue.

Delayed Claim Submission

Time often turns out to be the silent reason behind many denied claims. Even when every detail on a claim is correct, it can still get rejected if it’s sent after the payer’s deadline. As per Glenwood Systems, nearly 7% of claim denials happen just because they’re sent late.

And the real problem behind that is most clinics run on packed schedules and sometimes there’s simply no system to track due dates. But when deadlines slip and the payments get stuck which creates unpredicted revenue scenario.

The staff end up spending hours reworking what could’ve been cleared in one go. Its like all this just adds more hands to a broken process. Staying on top of timelines and tightening the process can save both effort and money.

How Automation Is Changing the Denial Game

When it comes to cutting down claim denials, numbers only tell part of the story. What matters is what’s happening in real healthcare organisations where change is happening in real time.

A recent Waystar + HFMA research on denials in healthcare, found something every healthcare provider should pay attention to, clinics using automation are not just speeding up claim approvals but also cutting down on costly errors and winnable kinda overall financial performance. What makes this report stand out is that it’s not about theory; it’s about real hospitals and clinics proving that the right tech, when used in daily workflows, can actually turn denials into dollars.

UCHealth Automates Prior Authorizations to Proactively Prevent Denials, leading to a 340% faster approval process and a 46% reduction in prior authorization denials. By bringing automation into the process, what once took days of endless back-and-forth paperwork now gets done almost instantly. It’s a shift that improved both efficiency and the overall energy of the workplace.

Avera Health Embraced Automation to Streamline its Revenue Cycle, reducing 80% of the manual work that once filled their queues. This transformation led to $20.6 million in accelerated cash flow and added $1.1 million in revenue by avoiding issues with timely filing. Adding automation in processes, Avera Health not only reduced the workload for their staff but also improved overall efficiency, allowing them to focus on more important tasks.

Conclusion

For clinics today, financial stability is about mastering the systems that keep care sustainable. As every denied claim tells a story of missed coordination and outdated workflows, and the only way we can fix those mistakes that can be treated with smarter tools. Under stricter healthcare policies, cost control will become the new gold standard. Clinics that rely solely on manual processes will struggle to keep up.

The shift toward AI-driven claim recovery is already turning “nice to have” into “need to have,” helping providers catch errors early, recover faster, and prevent future losses.