How Aave Works: The Business & Revenue Model Behind the DeFi Giant Explained

Money is changing faster than ever, and this time, it’s not the banks leading the charge; it’s the blockchain believers. The rise of DeFi (Decentralised Finance) has quietly opened the doors to a new kind of freedom, one where your money works for you, not through someone else.

That’s where Aave stands out as a quiet genius in a rapidly growing DeFi space. A recent report by Fortune Business Insights forecasts explosive growth for the global DeFi market, from $86.5 billion in 2025 to over $457 billion by 2032, with an annual growth rate of 26.9%.

Moreover, today, more than 14 million active DeFi wallets process over $48 billion in weekly transactions worldwide, a clear sign that decentralised finance isn’t just an idea anymore, it’s a full-fledged financial revolution.

By the Numbers: How Big Is the DeFi Space?

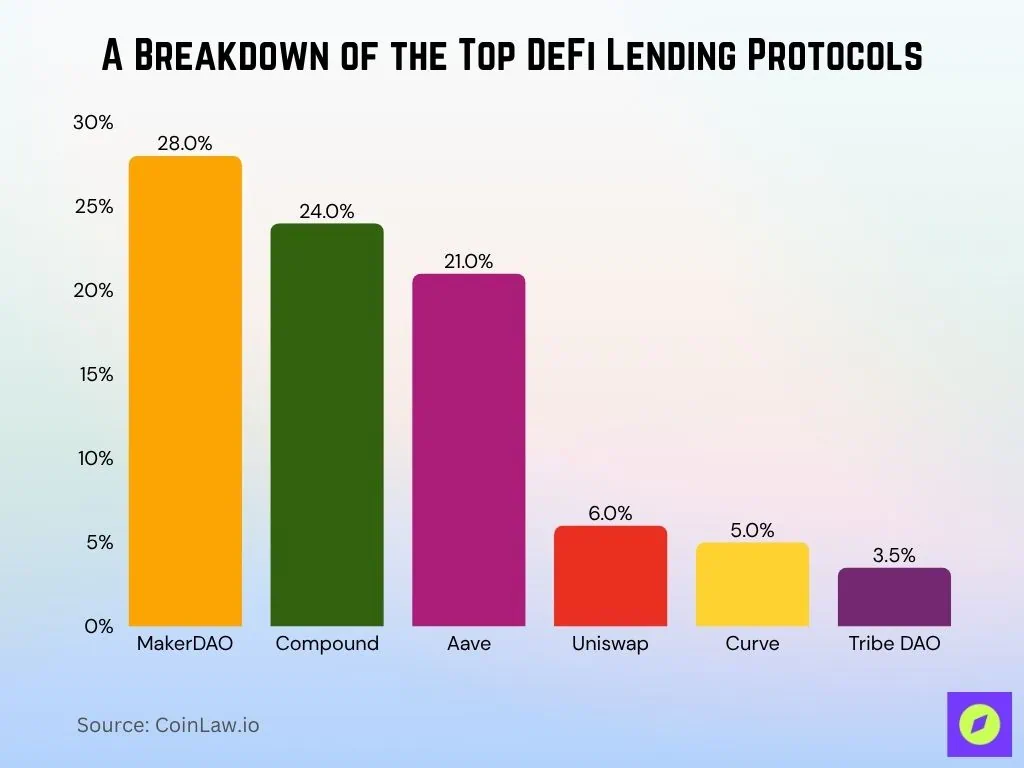

From Coinlaw's Defi Lending Protocols Statistics

- As blockchain moves further into the mainstream, DeFi lending users crossed 7.8 million in 2025, marking a 26% year-on-year growth.

- Decentralised exchanges (DEXs) also saw record activity, reaching about $462 billion in monthly trading volume in 2025.

- Aave continues to hold its ground as the #2 DeFi protocol by Total Value Locked (TVL), securing nearly $20.38 billion in smart contracts.

- Together, Aave, MakerDAO, and Compound account for more than 72% of the total DeFi lending TVL this year.

- Compound and Aave follow closely, with 24% and 21% market share, respectively. Aave’s multi-chain flash loans play a significant role in its growing popularity.

- The top five DeFi protocols — MakerDAO, Compound, Aave, Uniswap, and Curve — now account for approximately 84.5% of the overall DeFi lending market as of 2025.

- Asia and North America lead the way, together representing over 52% of DeFi users, supported by stronger crypto adoption and infrastructure.

- Younger investors, aged 20 to 35, make up nearly 59% of DeFi lending users, drawn to mobile-first, simplified platforms like Aave.

- Around 28% of DeFi platforms have started using KYC verification, making decentralised finance safer for everyone.

From DeFi Market Statistics 2025:

- Data and analytics account for a 15% share of the DeFi market.

- With rising user activity, Aave’s total value now stands around $7.5 billion in lending and borrowing

- Aave leads the DeFi lending market, with more than $14.6 billion across its liquidity pools.

- The top 100 DeFi tokens together hold a market capitalisation of $98.4 billion as of Q2 2025.

Source: Coinlaw

Everything You Should Know About Aave

As of 2025, Aave stands as one of the leading names in decentralised finance (DeFi), holding a strong market position. Aave remains the #2 DeFi protocol by total value locked (TVL) in 2025, locking approximately $20.38 billion in smart contracts, according to Coinlaw.

However, this global success story began quietly in 2017, when Stani Kulechov, then a law student from Finland, launched a small experiment that questioned how money could be moved. His idea was simple: what if people could lend and borrow crypto directly, without banks or mediators?

That project was ETHLend, built entirely on smart contracts running on the Ethereum network. It gave people freedom, the ability to transact trustlessly, without a single sheet of paperwork.

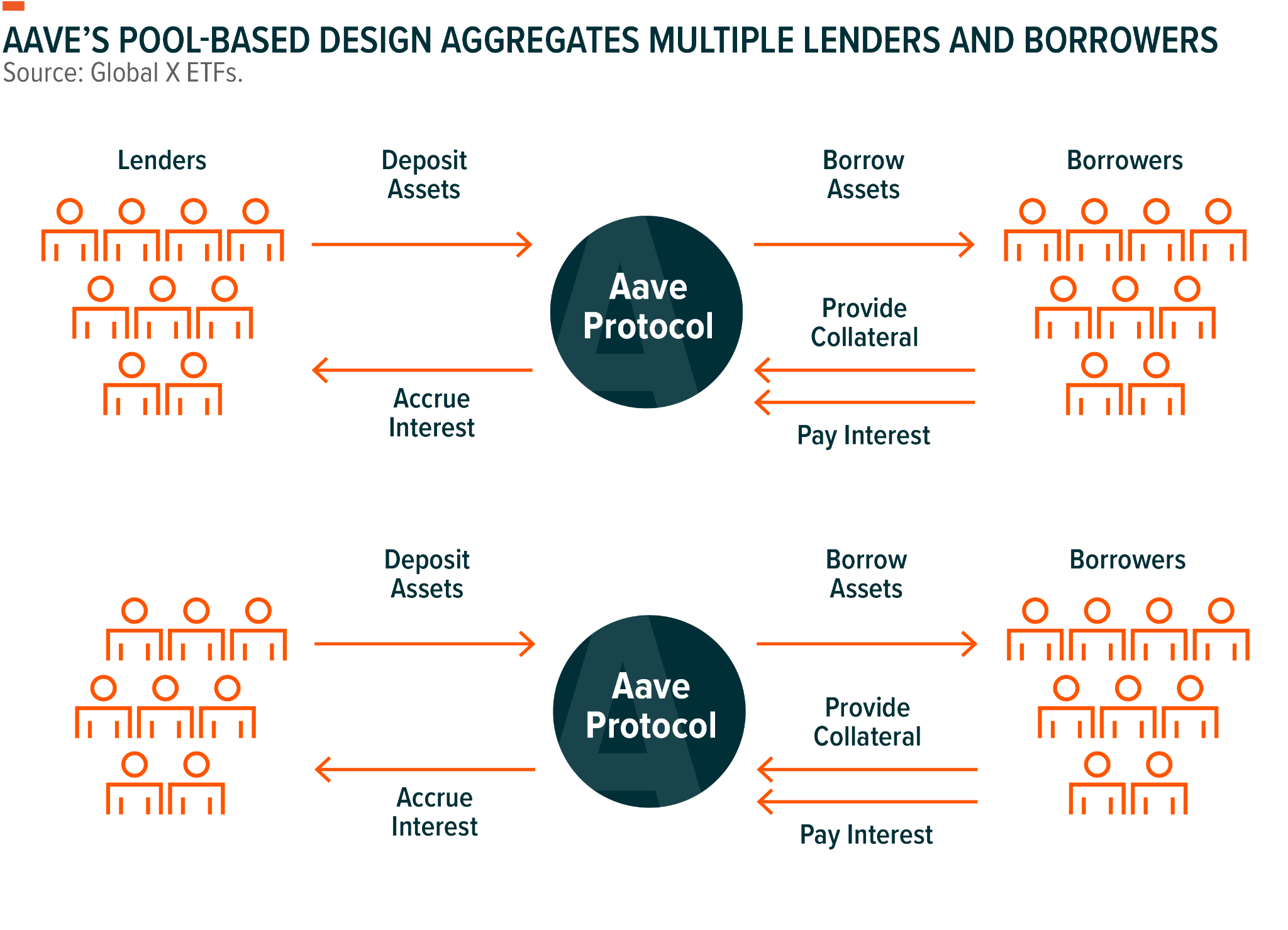

A year later, in 2018, ETHLend rebranded as Aave (meaning “ghost” in Finnish), marking a turning point for DeFi. The platform transitioned from a peer-to-peer lending model to a liquidity-pool model, where lenders and borrowers interacted through shared pools rather than individual deals. The result was a system that made crypto lending faster, safer, and far more transparent.

By 2020, Aave had earned credibility well beyond its code. Venture giants likeFramework Ventures and Three Arrows Capital backed the protocol with a $3 million investment, helping it evolve from a niche DeFi experiment into one of the most trusted lending protocols in the world.

Source: Global X

Aave’s growth story doesn’t stop there, its rise comes from a few key factors that continue to drive its success in DeFi.

Cross-chain reach

Aave’s strength lies in its cross-chain presence — running across more than a dozen blockchains, including Ethereum and Layer 2 networks like Arbitrum, Optimism, and Base. It’s what makes Aave one of the few truly borderless lending ecosystems in DeFi.

The power of GHO

Its native stablecoin GHO brings more balance to Aave’s system, keeping borrowing stable, transparent, and fully integrated into the protocol.

Flash loans

The concept of flash loans has completely changed how liquidity moves in DeFi, a feature that allows users to borrow and repay within a single transaction, solidifying Aave’s place as a true pioneer in on-chain finance.

Trusted by institutions

With initiatives like Horizon bridging DeFi and traditional finance, Aave is becoming a trusted gateway for institutions, built on transparency and security.

AAVE Token

The AAVE token powers Aave’s governance, giving holders the right to vote and shape the outcome of Aave Improvement Proposals (AIPs) across the network. It builds a sense of community ownership while keeping Aave truly decentralized.

Source: Coinlaw

Aave’s Business Model

Aave runs on a usage-based model; the more people use the platform, the stronger it becomes. Unlike traditional banks that earn from interest spreads or service fees, Aave’s revenue comes directly from user activity on the platform.

Every time someone deposits, borrows, or closes a position, a small protocol fee is charged, typically ranging from 0.05% to 0.1%. These small cuts add up, helping maintain liquidity and fund the overall ecosystem.

Another major source of revenue comes from Aave’s most innovative features, namely flash loans. Flash loans enable users to access liquidity from Aave’s pools for a single transaction, provided the borrowed amount, along with a small fee, is repaid within the same transaction. If the protocol allows it, borrowers can open a debt position instead of repaying instantly.

With Aave V3, this feature became even more flexible. The updated flashloan function allows users to access liquidity from multiple reserves simultaneously, enabling faster and more efficient transactions. Borrowers can also open variable-rate positions backed by collateral or credit delegation, expanding flash loans’ utility across Aave’s ecosystem.

Then there’s the AAVE token, which ties everything together. It’s not just a token — it’s a governance tool. Holders get to vote, propose changes, and help guide the protocol’s evolution. As Aave grows, the token’s relevance and demand tend to grow with it.

What makes Aave’s business model stand out is how naturally it rewards participation. Everyone involved — from lenders and borrowers to token holders — contributes to and benefits from the same ecosystem.

Conclusion

Aave has crossed a significant milestone with over $25 billion in active borrows, reinforcing its place as one of the strongest pillars in decentralised finance. It’s a practical shift that shows how DeFi is quietly moving into the core of modern finance —one that runs on liquidity, transparency, and innovation. In essence, Aave continues to strengthen its liquidity pools and expand into new networks, showing how a delicate balance between growth and regulatory alignment as a path forward looks even more promising.